Risk Indicators and Volatility in the First Quarter of 2025

April 10, 2025 2025-04-10 10:45

Risk Indicators and Volatility in the First Quarter of 2025

As we enter the first quarter of 2025, financial markets are bracing for potential shifts that could be influenced by various economic, political, and market-specific factors. Understanding risk indicators and market volatility is essential for entrepreneurs, investors, and financial analysts who are navigating this uncertain landscape. The early months of 2025 will set the tone for the rest of the year, and examining key indicators will help anticipate potential risks and prepare for market fluctuations.

Understanding Risk Indicators

Risk indicators are tools that financial analysts use to assess the likelihood of adverse events that could disrupt the market. These indicators help determine the stability of the economy and identify vulnerabilities in different sectors. The following are the most important risk indicators to watch in early 2025:

-

Inflation and Consumer Price Index (CPI)

Inflation rates are among the most critical economic indicators. If inflation rises significantly, central banks may respond by increasing interest rates. Higher rates can dampen consumer spending and increase the cost of borrowing, which can slow down the economy. Conversely, persistent low inflation could signal weak demand and economic stagnation. Early 2025 could see the continuation of inflationary pressures or signs of stabilization, both of which will heavily impact consumer confidence and economic growth. -

Interest Rates and Monetary Policy

Interest rates, determined by central banks, play a pivotal role in shaping market behavior. As central banks, such as the U.S. Federal Reserve, adjust rates to control inflation and stimulate growth, their decisions will directly affect borrowing costs and investment flows. Changes in monetary policy in the first quarter of 2025 could provide insight into whether we are entering a period of tighter economic conditions or continued accommodative measures. -

Geopolitical Events

Geopolitical instability can significantly increase market volatility. Potential trade disputes, sanctions, or regional conflicts can create uncertainty in global markets. In the first quarter of 2025, the geopolitical landscape—especially in relation to major economies like the U.S., China, and the EU—could introduce new risk factors that could send shockwaves through the global economy. -

Corporate Earnings Reports

Corporate earnings reports are another crucial indicator of economic health. These reports provide insight into how businesses are performing and adapting to changing economic conditions. The first quarter of 2025 will include reports from major companies, which will help analysts gauge whether businesses are successfully managing inflation, rising wages, and supply chain challenges. A downturn in earnings could signal broader economic issues, while strong results could suggest resilience despite economic pressures. -

Commodity Prices

Commodity prices, particularly oil, gold, and agricultural products, often serve as barometers for global economic conditions. A sudden spike in oil prices, for example, could indicate supply disruptions or geopolitical tensions, both of which can lead to higher costs across various industries. Monitoring fluctuations in commodity prices during early 2025 will provide valuable insights into economic stability and potential risks.

Volatility in Early 2025

Market volatility refers to the degree of variation in the price of financial instruments over time. High volatility can lead to sharp price movements in stocks, bonds, and other assets. Early 2025 could see elevated levels of volatility due to the following factors:

-

Economic Recovery and Adjustments

While many economies have recovered from the initial shocks of the COVID-19 pandemic, the adjustment phase in 2025 could create uncertainty. Countries may be adjusting fiscal policies, government spending, and tax rates to cope with the post-pandemic reality. The impact of these changes could cause short-term fluctuations in markets as investors respond to evolving economic conditions. -

Stock Market Performance

The stock market’s performance in the first quarter of 2025 will be a key indicator of investor sentiment and economic expectations. If stock indices experience sharp movements or face corrections, this could signal underlying economic concerns or investor uncertainty. With global markets adjusting to new monetary policies and inflationary pressures, early 2025 may be marked by heightened volatility as investors reassess their portfolios. -

Cryptocurrency Volatility

The cryptocurrency market is known for its extreme volatility, and this trend is expected to continue in 2025. With cryptocurrencies gaining more mainstream attention, shifts in market sentiment or regulatory news can trigger significant price swings. Early 2025 may see new developments in crypto regulations or technological advancements, leading to volatile price movements in digital currencies like Bitcoin and Ethereum. -

Global Trade and Supply Chain Risks

Ongoing disruptions in global supply chains, especially in sectors such as semiconductors, energy, and consumer goods, could impact market stability. The first quarter of 2025 will likely see continued efforts to resolve these supply chain challenges. Any new disruptions or delays could introduce further volatility into markets, especially in industries that rely heavily on just-in-time inventory systems. -

Investor Behavior and Risk Appetite

Market volatility is often driven by shifts in investor sentiment. If investors perceive higher risk in early 2025—due to geopolitical tensions, economic uncertainty, or other factors—they may pull back on their investments, contributing to market swings. Conversely, if investors become more optimistic about economic growth and corporate profitability, we could see a rise in market valuations and risk-taking behavior.

How to Prepare for Risk and Volatility in Early 2025

While risk and volatility are inherent in financial markets, entrepreneurs, businesses, and investors can take steps to mitigate their impact:

-

Diversify Portfolios: Spread investments across different asset classes to reduce the impact of market volatility on any single investment.

-

Monitor Economic Indicators: Stay updated on inflation, interest rates, and other key indicators that affect the market.

-

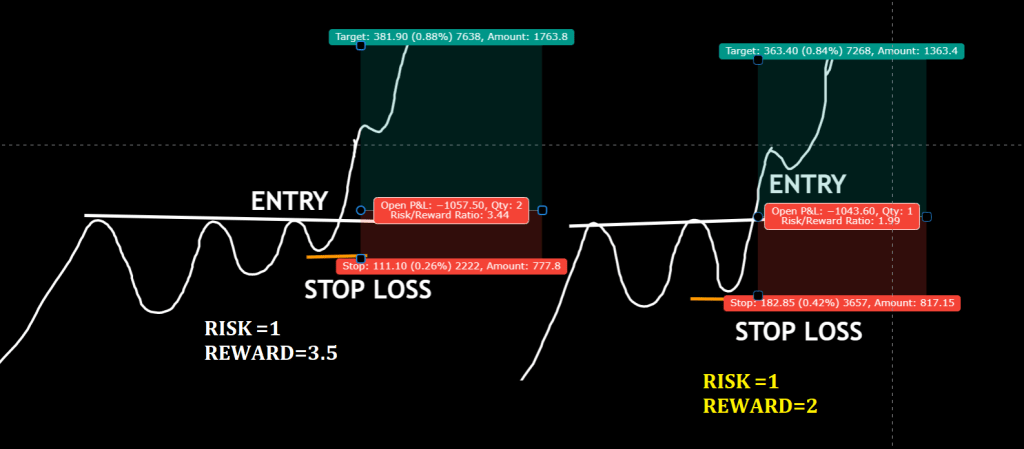

Implement Risk Management Strategies: Use hedging, stop-loss orders, and other risk management tools to protect investments from significant losses.

-

Focus on Long-Term Goals: While short-term volatility can be unsettling, focusing on long-term growth and maintaining a disciplined investment strategy can help weather the storm.

For more insights into risk indicators and market volatility in 2025, watch this video for an in-depth analysis:

Understanding these factors can help you navigate the uncertainties ahead and make informed decisions as we enter the first quarter of 2025.

Related Posts

Risk Indicators and Volatility in the First Quarter of 2025

April 10, 2025 2025-04-10 10:45Popular Tags